News

INVESTOR HUBAurcana Announces New Mineral Resource Estimate for the La Negra Mining Operation

December 3, 2014

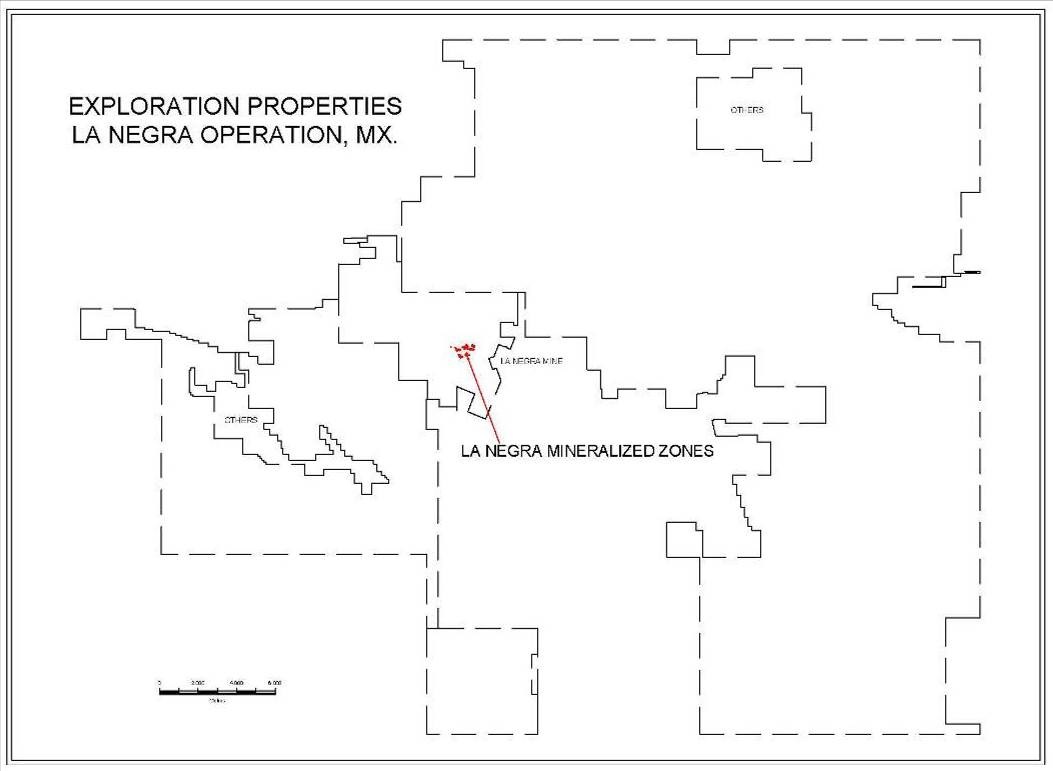

Vancouver, BC, December 3, 2014 - Aurcana Corporation ("Aurcana" or the "Company") (TSXV: AUN, OTCQX: AUNFF) is pleased to announce an updated resource estimate for the La Negra Mine, the Company's silver, zinc, lead and copper mining operation located in the State of Queretaro, Mexico.

AMC Mining Consultants (Canada) Limited ("AMC"), an independent mining consulting firm, has recently prepared a new mineral resource estimate (the “Estimate”) for the Company's La Negra mine. The Estimate is based on 14,578 assays comprised of 4,074 drillhole samples, 8,674 channel samples, and 1,829 longhole samples obtained by Minera La Negra S.A. de C.V. (a subsidiary of Aurcana) during the period from 2006 through to 2014, and by Industriales Peñoles S.A. de C.V. from 1967 to 2000. A summary of the Estimate is tabulated below:

MEASURED AND INDICATED RESOURCES FOR ALL DEPOSITS AND ALL BLOCKS WITH A MINIMUM |

RECOVERED VALUE OF US$30 AS OF SEPTEMBER 30, 2014

Classification |

Tonnes

|

Silver

(g/t) |

Copper

(%) |

Lead

(%) |

Zinc

(%) |

Silver Equivalent (g/t)

|

|

Measured

|

1,977,000

|

107

|

0.61

|

0.50

|

2.23

|

203

|

|

Indicated

|

2,748,000

|

54

|

0.45

|

0.22

|

1.04

|

110

|

|

|

||||||

|

Measured plus Indicated

|

4,724,000

|

76

|

0.52

|

0.34

|

1.54

|

149

|

|

Classification

|

In Situ Metal Quantities

|

||||

|

Silver

(oz.) |

Copper

(lb.) |

Lead

(lb.) |

Zinc

(lb.) |

Silver Equivalent

(ounces) |

|

|

Measured

|

6,821,600

|

26,777,200

|

21,869,800

|

97,347,600

|

12,907,200

|

|

Indicated

|

4,758,400

|

27,439,800

|

13,119,000

|

63,111,100

|

9,700,400

|

|

Measured plus Indicated

|

11,577,700

|

54,205,800

|

34,982,000

|

160,427,200

|

22,607,600

|

Ounces and pounds of in situ metal are calculated using only resource blocks with a recovered value of US$30 or greater, which corresponds generally with the $32/tonne operating cost provided by Aurcana for the La Negra Mine from January to October 2014. Metal prices and recoveries used for value and silver equivalent estimates are: Silver - $21.50/83%; Copper - $3.10/75%; Lead - $0.95/78%; Zinc - $1.00/80%. Silver equivalence is calculated using the following formula:

Silver equivalent=[((grade silver g/t)x((US$price silver /Troy Ounce)/31.10348)x(recovery of silver))+((grade copper %)x(US$price of copper/poundx22.046)x(recovery of copper))+((grade lead %)x(US$price of lead/poundx22.046)x(recovery of lead))+ ((grade zinc %)x(US$price of zincpoundx22.046)x(recovery of zinc))] divided by the price of silver/ounce to calculate silver equivalent in ounces, or by the price of silver in grams to calculate gram equivalency.

INFERRED RESOURCES FOR ALL DEPOSITS AND ALL BLOCKS WITH A MINIMUM RECOVERED VALUE OF US$30 PER TONNE

Classification |

Tonnes

|

Silver

(g/t) |

Copper

(%) |

Lead

(%) |

Zinc

(%) |

Silver Equivalent Grade (g/t)

|

Silver Equivalent Ounces

|

|

Inferred

|

642,000

|

55

|

0.55

|

0.18

|

1.54

|

130

|

2,676,800

|

Notes:

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the estimated Mineral Resources will be converted into Mineral Reserves. The Estimate may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. La Negra is a producing mine; key risk factors that may have an adverse effect on the continued development of the mineral resources estimated herein include Mexican taxation issues and metals prices.

- The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the Standards Committee on Reserve Definitions and adopted by the CIM Council on November 27, 2010.

- Mineral Resources tonnage and contained metal have been rounded: tonnes to the nearest 1,000; silver to the nearest gram; copper, lead and zinc to the nearest two decimal places, to reflect the accuracy of the estimate. Numbers may not add up due to rounding.

Three dimensional solid models of eleven mineralized zones were generated by Aurcana using SURPACTM geological software; the solids were then used to constrain the resource estimate for each mineral zone. Solid models of the underground workings were also provided by Aurcana and the workings were subtracted from the mineral zone solids used to estimate the quantities of resources. Therefore the Mineral Resources (grades and tonnes) were estimated within the geological solid models with the workings extracted. The Estimate was created using DATAMINE Studio 3 software.

A block model was created to contain all eleven mineralized zones. Within individual zones the size of resource estimation blocks used do not exceed 5 x 5 x 5 metres and are not diluted. The grades in the block model were estimated using ordinary kriging.

Qualified Persons & Technical Report

The Estimate has an effective date of September 30, 2014, meets the guidelines and form as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and CIM standards, and was prepared for Aurcana by AMC. The resource estimation was undertaken by Greg Z. Mosher, P.Geo of AMC, a qualified person as defined under NI 43-101 reporting requirements. Mr. Mosher has consented to applicable disclosure contained herein regarding the Estimate. Mr. Mosher is independent of Aurcana and its subsidiary companies.

AMC is currently preparing a Technical Report in support of the Estimate. This report will be filed by the company in its entirety on SEDAR (www.sedar.com) within 45 days of the date of this news release.

About Aurcana's La Negra Mine

The La Negra mine was discovered and developed by Industriales Peñoles S.A. de C.V (“Peñoles”). The mine commenced production in 1970 as an underground operation and produced at 800 tonnes per day (“tpd”) until the mine was put on care and maintenance in 2000. During this 30-year period Peñoles mined approximately 6,600,000 tonnes of ore producing 36 million ounces of silver, 323 million pounds of zinc, 70 million pounds of copper, and 161 million pounds of lead. In 2006 Aurcana Corporation acquired an initial 80% joint venture interest in the property, subsequently increasing its interest to 99.86%. La Negra was placed back into production June 1, 2007 by Aurcana at a rate of 1,000 tpd.

- Between June 1, 2007 and December 31, 2013 Aurcana mined 3,226,000 tonnes grading 73 g/t silver, 1.27% zinc, 0.37% lead and 0.49% copper at the La Negra Mine.

- In the first nine months of 2014 725,388 tonnes were milled at the La Negra mine producing 1,102,222 ounces of silver and 26,126 tonnes of copper, lead and zinc concentrates.

- Since 2007 Aurcana has mined in excess of three times the estimated tonnage of the mineral inventory as calculated by Peñoles prior to the time of Aurcana’s acquisition of the La Negra Mine and as of this current resource estimate continues to extend the potential mine life as a result of successful in-mine exploration. Approximately 35% of production at the La Negra Mine comes from outside the areas included in the last mineral resource estimate on the La Negra Mine, which was prepared on behalf of Aurcana in 2012.

- Mineralization occurs as mantos or chimneys within skarn developed along the contact between diorite intrusions and Lower Cretaceous limestone strata. Individual mantos vary in size with dimensions ranging from 40 meters to 300 meters long, from 0.50 meters to 40 meters thick and up to 300 metres in height.

The Company’s management believes that the opportunity to find and develop new zones of mineralization at La Negra is excellent. The new three-dimensional models prepared in connection with the Estimate serve the purpose of not only constraining resource block models but also highlights unexplored gaps between existing mantos and obvious mineralized trends. Thus far five exploration targets have been flagged for further drilling, all within 200 metres of existing underground workings. These near-term targets mesh well with La Negra’s large, 82,000 hectare property position in the region, known to host similar rock types and structures as are found at La Negra. As metal prices and operating margins improve these brownfields and greenfields exploration opportunities will allow the resumption of aggressive exploration.

Kevin Drover, President and CEO, comments: “This new mineral resource estimate completed by AMC provides Aurcana with a critical tool necessary to plan the mining sequence effectively and efficiently. This new Estimate more precisely represents grade distribution and continuity within the mine area. The model will support life-of-mine planning with the selectivity required to manage grade control and mining-rates that are in-keeping with our operational experience of the past six years.”

The technical information contained in this news release has been reviewed by Jerry Blackwell, P.Geo, a Director and technical advisor of the Company. Mr. Blackwell is a Qualified Person ("QP") as defined by NI 43-101.

Corporate

The Company's shares are also traded in the United States on OTCQX under the symbol "AUNFF". Investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on www.otcqx.com and www.otcmarkets.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF

AURCANA CORPORATION

“Kevin Drover”, President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

Phone: (604) 331-9333

Toll Free: (866) 532-9333

Fax: (604) 633-9179

Gary Lindsey, Corporate Relations

Phone: (720)-273-6224

Email: gary@strata-star.com

NR-17-14

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain forward-looking statements, including statements regarding forecast silver production, silver and other metal grades, recoveries, potential mineralization, exploration result, future plans and objectives of the Company and the business and anticipated financial performance of the Company. These statements are forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to mining and processing of mined ore, achieving projected recovery rates, anticipated production rates and mine life, operating efficiencies, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or does not expect", "is expected", anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

Actual results may differ materially from results contemplated by the forward-looking statements. Important factors that could differ materially from the Company's expectations include, among others, risks related to international operations, unsuccessful exploration results, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as changes in metal prices, changes in the availability of funding for mineral exploration and development, unanticipated changes in key management personnel and general economic conditions. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, oral or written, made by itself or on its behalf, except as required by applicable law. Accordingly, readers should not place undue reliance on forward-looking statements.